Empowering Long Island with Energy Solutions

Solar Energy & Storage

Power House, your local Long Island-based solar contractor, is committed to creating a sustainable and cost-effective future for homeowners and businesses. Our mission is to help you save on utility bills while fostering a cleaner Long Island for generations to come. Being rooted in the Long Island community, we are not just another corporation; we are your neighbors. Our unwavering promise is to be here for the long run. We strive to make solar energy accessible, affordable, and understandable for everyone on Long Island. Together, let’s harness the power of the sun and create a sustainable future for our cherished community.Why Solar is the Future for Homeowners

Reduced Energy Costs Solar power significantly reduces or eliminates electricity bills, offering long-term financial savings. Environmental Impact Solar energy is a clean, renewable resource that reduces your carbon footprint and fosters a greener, healthier planet. Energy Independence “going solar” decreases or eliminates your dependence on the grid and protects you from rising utility costs. Increased Property Value Homes with solar installations are more in demand, solar homes close faster and at higher prices.

HAVE QUESTIONS? WE'VE GOT ANSWERS.

How much can I save by switching to solar energy?

Savings vary depending on energy consumption, roof size & structure, and shade analysis. In almost all cases, the cost of “going solar” is far less (tens of thousands of dollars) than the cost of paying PSEG year after year.

What is the lifespan of solar panels installed by Power House?

We only install Tier 1 Panels that offer a 25yr warranty. Most panels are expected to last between 40–50 years. As your solar partner, we offer a 30yr Comprehensive Installation Warranty as well.

What are the Benefits of Solar Energy?

Solar energy is clean, renewable energy that lowers or eliminates electricity costs and reduces carbon emissions. There is no maintenance required and it gives you the opportunity to generate your own power.

What government incentives are available today for going solar?

The federal government gives up to a 30% tax credit of the project cost. New York State gives up to a $5,000 tax credit. Together, these incentives pay for between 35% – 50%+ of the cost to go solar. (depending on solar system size)

What is net metering?

Net metering in New York allows homeowners with solar panels to receive credits for excess electricity their systems generate and feed back into the grid. These credits offset future electricity usage, effectively reducing utility bills. For example, if your solar panels produce more electricity than your home consumes during the day, the surplus is sent to the grid, and you earn credits. Later, when your system produces less than your consumption—such as at night or during cloudy days—you can use these credits to offset the electricity you draw from the grid. It’s important to note that net metering policies can vary by utility and are subject to change. Therefore, it’s advisable to consult with your local utility provider or a professional solar installer to understand the current policies and how they apply to your specific situation.

How do I know how much money I’m savings and how much energy I’m producing and consuming?

Every Power House solar installation comes with a free monitoring app which you monitor on your smart phone, computer, or device of choice. With the Enphase Enlighten app, you can see exactly how much energy your home is consuming and how much energy your solar system is producing in real time…The app even converts kilowatt hours to dollars so you can watch your savings grow!

Am I able to get a brand-new roof and switch to solar with no money down?

Absolutely! In fact, bundling solar + roofing + heat pumps will increase your incentives and overall savings.

What kind of maintenance is involved with a solar system?

There is no prescribed or preventative maintenance for a solar installation…However, if your system ever requires service or repair, all equipment comes with a 25 year warranty from the manufacturer and Power House includes 30 yrs of installation warranty coverage for a worry free solar experience.

Do solar panels work during cloudy days or at night?

Yes, solar panels still produce electricity on cloudy days, albeit at reduced efficiency. At night, you’ll rely on stored energy from your solar battery system or draw power from the grid if needed.

What maintenance is required for solar panels?

Solar panels are low-maintenance and require occasional cleaning to remove dirt and debris. PowerHouseLI.com offers maintenance services to ensure your system operates at peak efficiency for years to come.

HOW DOES SWITCHING TO SOLAR POWER SAVE LONG ISLANDER’S BIG BUCKS?

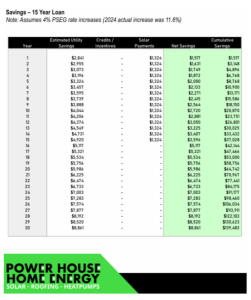

Let’s look closer at why switching to solar is a “no brainer”…The below scenario is for an average LI home with an average PSEGLI electric bill (your bill may be higher or lower, the below example is based on Long Island averages and is for illustrative purposes)

· An average Long Island home consumes 10,000kWh/yr of energy is paying an average of $221/mo to PSEGLI.

· For this amount of household electric usage, a prescribed solar system of 8,500kWDC would typically generate enough energy to eliminate the $221/mo PSEG bill (depending on roof slope, azimuth and shade)

· The prescribed 8,500kWDC solar system installation cost is approximately $27,090

· This system would be eligible for a 30% Federal Tax Credit of $8,127 PLUS a NYS Tax Credit of $5,000 = $13,127 in Total Incentives

· Cost Breakdown: Total Cost: $27,090, Government Contribution= $13,127, Customer Cost= $13,963 (for this example, 48% of the cost to “go solar” is paid for by government incentives)

HOW DOES “GOING SOLAR” WITH NO MONEY DOWN WORK?

For the example above, customer has opted to take advantage of one of our No Money Down Solar Financing. The solar loan is a custom finance option that has two loan components:

· SAC (Same As Cash Loan): This loan offers deferred interest and deferred payments for 18 months. This is where the $13,127 of incentives (Government Contribution) is financed. Rather than financing the entire project cost ($27,090) into an interest-bearing term loan, we offer the SAC Loan as a Tax Credit Bridge Loan…This loan is like a loan you might give to your kids or best friend: “Here’s the money, just pay me back when you receive your tax credits”. The SAC Loan affords our homeowners a significantly lower monthly solar loan payment (about ½ the monthly payment amount that fully financing the project in a term loan would have)…When you sign up for solar, you do not have the tax credits yet…You receive your tax credits when you file your income taxes, based on income tax liability. Power House strongly recommends consulting with your tax advisor on your eligibility to receive the tax credits…The SAC loan is intended to be paid off by month 18 and no matter what month you “go solar” there is always at least one income tax period to collect your tax credits before the SAC is due…As long as the SAC is paid off by month 18 (following installation) you will not be charged any interest for the $13,127…If you do not pay off the SAC by month 18, any remaining balance will roll over into the RIL (Reduced Interest Loan) at the same interest rate as the RIL and increase payment accordingly. Many competing finance options will charge over 20%+ interest, calculated back to the day the loan was originated, should a customer prefer to keep their tax credits…Our loan is different…It does not penalize you by charging you a higher interest should you decide to keep your tax credits. Our Finance Option gives customers more flexibility with their tax credits…If a customer prefers to keep their tax credits to reinvest, go on a vacation, for another home project or any other purpose, they may do so without having to pay an outrageous interest rate.

· RIL (Reduced Interest Loan): This loan is where the $13,963 of Customer Cost is financed. For this example, the customer chose to finance their solar project for 15yrs @ 4.99%…

· $13,963 Financed for 15 years @ 4.99% = $110/mo…

· The PSEG bill for this example was $221.00/mo. The PSEG bill would be completely offset (except for a monthly PSEG connection fee + CBC of about $17/mo) by the solar energy being produced on the customers roof for a $110/mo solar loan payment which represents monthly savings of $126/mo!

· With an average PSEG Rate escalation of 4%/yr, installing the prescribed system would generate lifetime savings of $139,000+

INCENTIVES

Federal & State Incentives pay for up to half the cost of “going solar”…The Federal Government offers a 30% tax credit for the project cost. New York State gives 25%, up to a $5,000 tax credit. Together, these huge government incentives pay for up to 50% the cost of switching to solar on Long Island with Power House Home Energy. Even if these tax credit incentives did not exist, solar would still save you tremendously…Because these incentives DO exist, going solar is a “no brainer”…